Learning About Money

It’s never too early to start talking about money. Whether your child is opening their first bank account or saving for a car, Libro is here to grow with you, every step of the way.

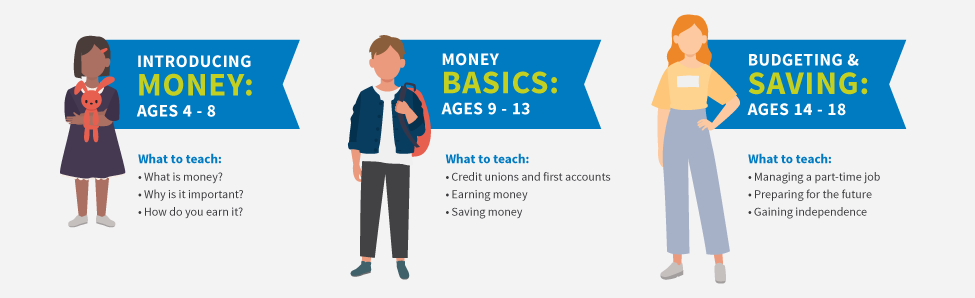

Introducing Money

Ages 4-8

For young children, it’s a good time to introduce the concept of money, why it is important and how you earn it. At this age, children may have seen you use money when paying at a store or have been given money for a gift. These are great opportunities to discuss the concept of money and be open to questions.

At Libro, we have fun and useful resources for young children to learn about the concept of money. Take a look:

Money Basics

Ages 9 to 13

Tweens earning money from allowance, gifts, or small jobs? It’s a great time to open their first Libro savings account! Our Coaches help them learn to save, grow their money, and use a debit card wisely—all in a safe, supportive environment.

At Libro, we have fun and useful resources for tweens to learn about earning and saving money. Take a look:

Budgeting & Saving

Ages 14 – 18

Help your teen build financial independence by budgeting with real expenses, like their cell phone bill. Discuss saving, using a debit card, and planning for future costs like tuition and living expenses.

At Libro, we have useful resources for teens to learn about budgeting and saving for the future. Take a look: